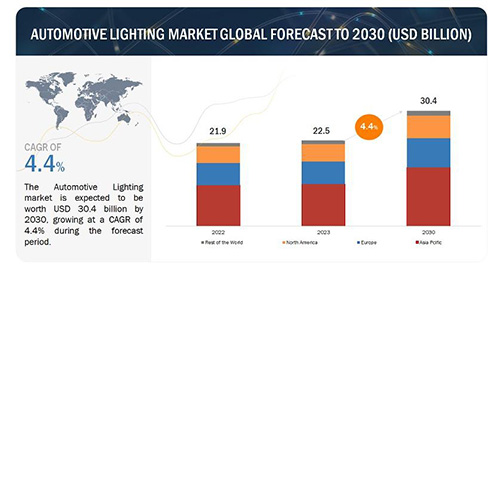

Automotive lighting market wordwide size was valued at USD 22.5 billion in 2023 and is expected to reach USD 30.4 billion by 2030, at a CAGR of 4.4%

Automotive Lighting Market for ICE & Electric Vehicle by Technology (Halogen, LED, Xenon), Position andApplication (Front, Rear, Side, lnterior, Adaptive Lighting, Electric Vehicle, Two-Wheeler Position Type and RegionGlobal Forecast to 2030

Automotive Lighting Market Size, Growth Report & Forecast

Automotive lighting market wordwide size was valued at USD 22.5 billion in 2023 and is expected to reach USD 30.4 billion by 2030, at a CAGR of 4.4%. Automotive Lighting is undergoing a transformatve evolution driven by technological advancement, increasing safety concerns among car users and changing consumer preferences. The market for automotve lightng has been pushed by governments’ adoption of sophisticated safety measures and the rise in demand for luxury vehicles, thereby driving the Automotive lighting market.

Automotive Lighting Market Growth Dynamics

DRIVER: Lighting Regulations for better visibility and on-road safety.

Globally, stricter lighting regulations in developed nations like Europe and North America illuminate the path for a safer future on the road. According to the World Health Organization (WHO), nearly 1.3 million lives are lost annually due to traffic accidents; governments are prioritizing improved driving conditions with advanced automotive lighting systems, which play a crucial role. Driving in heavy traffic, especially in areas with limited daylight, demands clear visibility. Here's where regulations like the 2011 European Union mandate for daytime running lights (DRLs) come into play. These aren't meant to increase the driver's visibility but to make vehicles highly visible to other road users, reducing the risk of collisions. in such cases, the impact of DRLs is undeniable. According to the US National Highway Traffic Safety Administration (NHTSA),there is a reduction in fatal crashes by 13.8%. The recent legalization of adaptive lighting in the US paves the way for even greater safety advances. In a proactive move, japan became the first country to mandate automatic headlights in 2020.

These regulations are more than just lines on paper; they're turning roads into safer spaces for everyone. Advanced automotive lighting systems, fueled by stricter regulations, are shining a beacon of hope on a future where driving is not just about getting somewhere but about getting there safely and efficiently.

RESTRAINT: High cost of LED Lights

The high cost of LED lights is a key concern for the automotive lighting market. Halogen and Xenon/HID have become less popular with the introduction of new technologies. Halogen lights have the major disadvantage of heating and wastage of energy, whereas Xenon light is more complex and requires some time to achieve full brightness. LED, on the other hand, is small and allows significant manipulation for various shapes and designs. it consumes less energy and emits brighter light than halogen. However, LED is more expensive than other technologies due to its high production cost. Materials such as indium gallium nitride, aluminum gallium indium phosphide, and aluminum gallium arsenide are the maior cost-incurring materials for manufacturers. Nowadays, LEDs are used with a projector, compared to conventional lights requiring reflectors, Projector headlights are more expensive than reflector headlights and require more space within the vehicle. Latest advancements, such as OLED and matrix LEDs, are costlier than normal and have only restricted adoption in previous cars.

Although LED headlights have numerous advantages, their high production expenses and closing pricing currently confine their usage to high-end or premium vehicles, mainly in cost-sensitive countries. However, as the LED light market expands and reaches mass customers, it will likely notice the fall in prices and enable LED lighting suppliers to improve their profit margins.

OPPORTUNITY: Advancement in Lighting Technologies

Matrix LED, OLED, laser, and adaptive lighting are new and promising technologies for automotive lighting manufacturers. OLED is an emerging solid-state lighting technology that has the potential to emit light across large surfaces. it is a niche technology still in the research and development phase. OLED is likely to be introduced in the premium segment vehicles shortly. However, the technology would require 10 to 15 years to gain a significant market share. Adaptive driving beam(ADB) systems are glare-free lighting systems that provide permanent high beams without dazzling oncoming vehicle drivers. The feature that makes the adaptive driving beam headlights stand out is that this system can adjust to the conditions and point the beam in a way that won't produce a glare on other drivers' windshields. With the National Highway Traffic Safety Administration's (NHTSA) approval, automakers can install this technology in vehicles in the United States.creating a safer and more convenient future on the road. In August 2023, Valeo introduced its Premium Adaptive Driving Beam (ADB) technology, which helps maximize the light in all road conditions for improved comfort and safety, directing the beam of light only where it is needed and reducing the glare for oncoming drivers. This Premium Adaptive Driving Beam(ADB) technology is available for Passenger cars, buses, and Robo taxis. Automotive adaptive lighting is also expected to grow globally, especially in developed countries. in countries like lndia and China, there is a growing trend of equipping luxury vehicles with adaptive headlights. Recently, Audi announced updates to its e-tron GT Quattro electric sports car,including an improved lighting system with Matrix LED headlights and dynamic light sequencing. Other brands, such as Porsche, have its Dynamic Light System, and Lexus offers Bladescan Adaptive Headlights in their vehicles. The efficient performance of these technologies has attracted the attention of major automakers, which will create futuristic growth opportunities for the global Automotive Lighting market in the coming years.

CHALLENGE: Less penetration of advanced lighting in commercial vehicles

Commercial vehicles such as freight trucks operate thousands of miles every day. Owing to this factor, using advanced lighting technologies may not be feasible for manufacturers. High cost discourages them from providing advanced lighting systems in commercial vehicle segments. Also, the durability and reliability of advanced lighting systems in diverse and demanding conditions might concern fleet managers. Heavy vehicles are continuously driven for long routes without much breaks; advanced lighting technologies like adaptive driving beams and matrix LEDs will be helpful to avoid accidents with better visibility for drivers. However, these advanced lighting systems are significantly more expensive than traditional halogen or xenon headlights, This is a major barrier for cost-conscious commercial vehicle fleets, which prioritize operational efficiency and profit margins.

Various organizations have laid stringent regulations for better visibility and safety in commercial vehicles. According to the Economic Commission for Europe (ECE), trucks in Europe must have automatic leveling. Trucks must be installed with LED headlamps, and if the headlamps are equipped with light sources > 2,000 lumens (usually xenon), automatic leveling and a headlamp cleaning system must be installed. Hence, even with several benefits of advanced lighting for commercial vehicles that run continuously without any time bar, whether day or night, only a few commercial vehicle manufacturer shave introduced advanced lighting systems in their vehicles. This results in less penetration of advanced lighting installation in commercial vehicles.

Automotive Lighting Market Ecosystem.The major OEMs of the Automotive Lighting Market have the latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the Automotive Lighting Market include Robert Bosch (Germany), HELLA GmbH & Co. KGaA (Germany), Johnson Electric (China), Denso Corporation (japan), and Continental AG (Germany).

If you need any automotive lightings,welcome to contact Excellent Lighting Group.